Knock Out Factors Business Definition

What is Knockout Option?

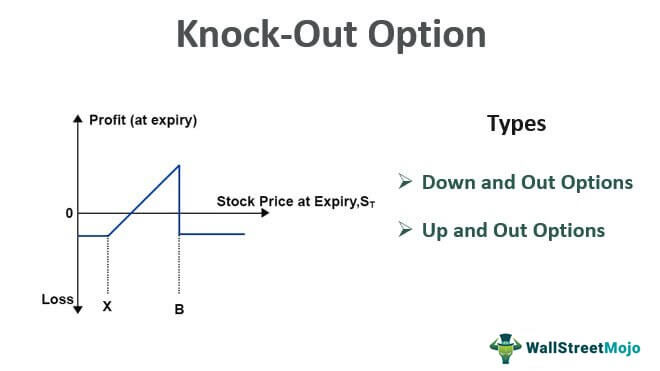

A knock-out option is a derivative contract in option, which loses its entire value if the price of the underlying asset reaches up to a certain level and option contract expires worthless. In such a case, the buyer does not get payoff and option writer receives fixed payoff if the price of the underlying reaches up to a certain level. Knock-out price decides the level of options contract that the buyer or seller (writer) can hold.

Example

Stock X trading at $200 per share, an investor decides to buy a call option of strike $210 at with a knockout price is $220 at $2. In plain vanilla option call option of a strike, $210 is at $5. The buyer is bullish on the stock, but have a doubt regarding the price level will cross above $220. If by the expiry of that option, the contract price of the stock reaches the level of $220, then the option contract will expire worthlessly. In case it does not hit $220, then the option continues to be valid until the expiry of the contract.

- Scenario 1: The stock price of X remains below $210. In this case, the Knock-out call option buyer will face a loss of $2, and regular option buyers will face a loss of $5 since the call strike becomes out of money.

- Scenario 2: The stock price of X is above $210 but not above $220. In this case, the knockout option buyer will have more benefit since the price paid to buy a call of $210 is $2 compared to the regular option buyers.

Assume if the stock price of X by the end of the options contract An option contract provides the option holder the right to buy or sell the underlying asset on a specific date at a prespecified price. In contrast, the seller or writer of the option has no choice but obligated to deliver or buy the underlying asset if the option is exercised. read more period is $218, then the regular option buyer will get a profit of $3 ($218-$210-$5=$3), and Knockout option buyer will receive a profit of $6 ($218-$210-$2=$6) - Scenario 3: The stock price of X crosses the level of $220, the knockout option ceases to exist while the regular option trader will continue to receive profit as per price.

Assume if the stock price of X is $250, then a regular call option buyer of $210 at $5 will get a profit of $35 ($250-$210-$5=$35).

You are free to use this image on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Knock-Out Option (wallstreetmojo.com)

Process

Barrier Options:

- Knockout Option: If the underlying asset price crosses a predetermined price, the option contract becomes worthless.

- Knock-in Options: Option contracts becomes valid and comes into existence only after the price of an underlying asset reached a certain price.

Knockout options traded in over the counter Over the counter (OTC) is the process of stock trading for the companies that don't hold a place on formal exchange listings. The broker-dealer network facilitates such decentralized trading of derivatives, equity and debt instruments. read more (OTC) market, mostly used in commodity and currency markets by large businesses to manage their positions. Only in case of in the money option contract, there is a positive payoff only if the option strike is in the money at the expiry, and the knockout price is not breached by the underlying asset Underlying assets are the actual financial assets on which the financial derivatives rely. Thus, any change in the value of a derivative reflects the price fluctuation of its underlying asset. Such assets comprise stocks, commodities, market indices, bonds, currencies and interest rates. read more .

Why would the buyer Prefer to Buy a Knockout Option?

- This is cheap in comparison with plain vanilla options traded on the exchange.

- In international business, such an option is used to achieve small profits instead of speculating major movements within the life of trade.

- Since the knockout option contract is customized contracts, it can be adjusted as per individual needs compare to exchange-traded option contracts where terms are regulated by an exchange.

Types

#1 – Down and Out Options

An option contract that gives right but not obligation to buy or sell the underlying asset at a certain price only if, price of an asset does not fall below the given barrier of price during the option contract period.

Example

The stock price of Stock XYZ is $100. The buyer decides to buy a call option of strike $90, while the barrier on the downside of the stock is $80. Before the expiry of an option contract, if Stock XYZ touches $80 price, this call option will expire worthlessly.

#2 – Up and Out Options

An option contract gives right but not the obligation to buy or sell the underlying asset at a certain price only if, price of an asset does not go above the certain barrier of price during the option contract period.

Example

Stock XYZ trading at $100. The buyer decides to buy a put option Put Option is a financial instrument that gives the buyer the right to sell the option anytime before the date of contract expiration at a pre-specified price called strike price. It protects the underlying asset from any downfall of the underlying asset anticipated. read more of strike $90 with a barrier on the upside is $120. If within the life of the options contract underlying asset does not cross the price of $120, then the option contract continues to be valid; otherwise, it expires as worthless.

Difference between Knock-out Options and Knock-in Option

| Particulars | Knockout Option | Knock-in option |

|---|---|---|

| Definition | Options contracts, which get expired as worthless if the price of an underlying asset reaches a certain price. | An option contract, which will come into existence only if the price of an underlying asset reaches a certain price. |

| Good for | Beneficial for speculators. | Beneficial for hedgers and speculators. |

| Expectation | The certain price levels will not be breached by an underlying asset. | Certain Price level needs to breach to activate knock-in options. |

| Risk | In the case of a major movement in the market, a knockout option will be worthless. | In the case of stagnated or low movement in the market, Knock in options will not make any sense. |

Advantages

- Limited Cash Outflow: Compare to other option contracts, cash flow payout is very less, resulting in the limited loss if the trade is not executed as per expectation.

- Tailor-made Contracts: Knockout options traded in the OTC market OTC markets are the markets where trading of financial securities such as commodities, currencies, stocks, and other non-financial trading instruments takes place over the counter (instead of a recognized stock exchange), directly between the two parties involved, with or without the help of private securities dealers. read more ; it helps in personalizing option contracts so it can be made as per requirement.

Disadvantages

- High volatility risk: Trader need to analyze risk in the up and downside since, in case of major movement, traders will lose an opportunity or might face loss.

- No Hedging Hedging is a type of investment that works like insurance and protects you from any financial losses. Hedging is achieved by taking the opposing position in the market. read more opportunity: Traders who prefer to hedge their positions with options to avoid major loss might face a huge loss in case of major movements against the trade, and such an option might be worthless.

- OTC Contracts: For a regular trader, such an option is not available since it is available in the OTC market.

- Lack of liquidity and regulator in a contract: There is a risk of default Default risk is a form of risk that measures the likelihood of not fulfilling obligations, such as principal or interest repayment, and is determined mathematically based on prior commitments, financial conditions, market conditions, liquidity position, and current obligations, among other factors. read more in case of OTC contracts since both parties depend on each other for trust. It is very little or almost no liquidity in the knockout option since it is tailor-made as per the need of an individual.

Conclusion

Knockout options are highly preferable for commodity and currency markets For those wishing to invest in currencies, the currency market is a one-stop solution. In the currency market different currencies are bought and sold by participants operating in various jurisdictions across the world. It is important in international trade and is also known as Forex or Foreign Exchange. read more because of its features. In less volatile market speculators who still want to generate profit, such options are a better choice since the price is comparatively lower than the regular exchange-traded option, while terms and periods can be customized.

Recommended Articles

This has been a guide to what is Knockout Options? Here we discuss examples, types, and why buyers prefer to buy knockout options along with advantages and disadvantages. You may learn more about financing from the following articles –

- Like-Kind Exchange

- Option Chain

- American Options

- How to Trade Options?

Reader Interactions

Knock Out Factors Business Definition

Source: https://www.wallstreetmojo.com/knock-out-option/

0 Response to "Knock Out Factors Business Definition"

Postar um comentário